Did you go to the top for snail powder and self-help pot? Explore the convenient fast food track

Editor’s note: This article comes from Huaying Capital, a column of Entrepreneurship State.

These days, Chinese, who loves to eat, has divided into two routes: one is the road of chefs in the circle of friends of the ingenious group, and the other is the road of convenient and fast food for the lazy group.

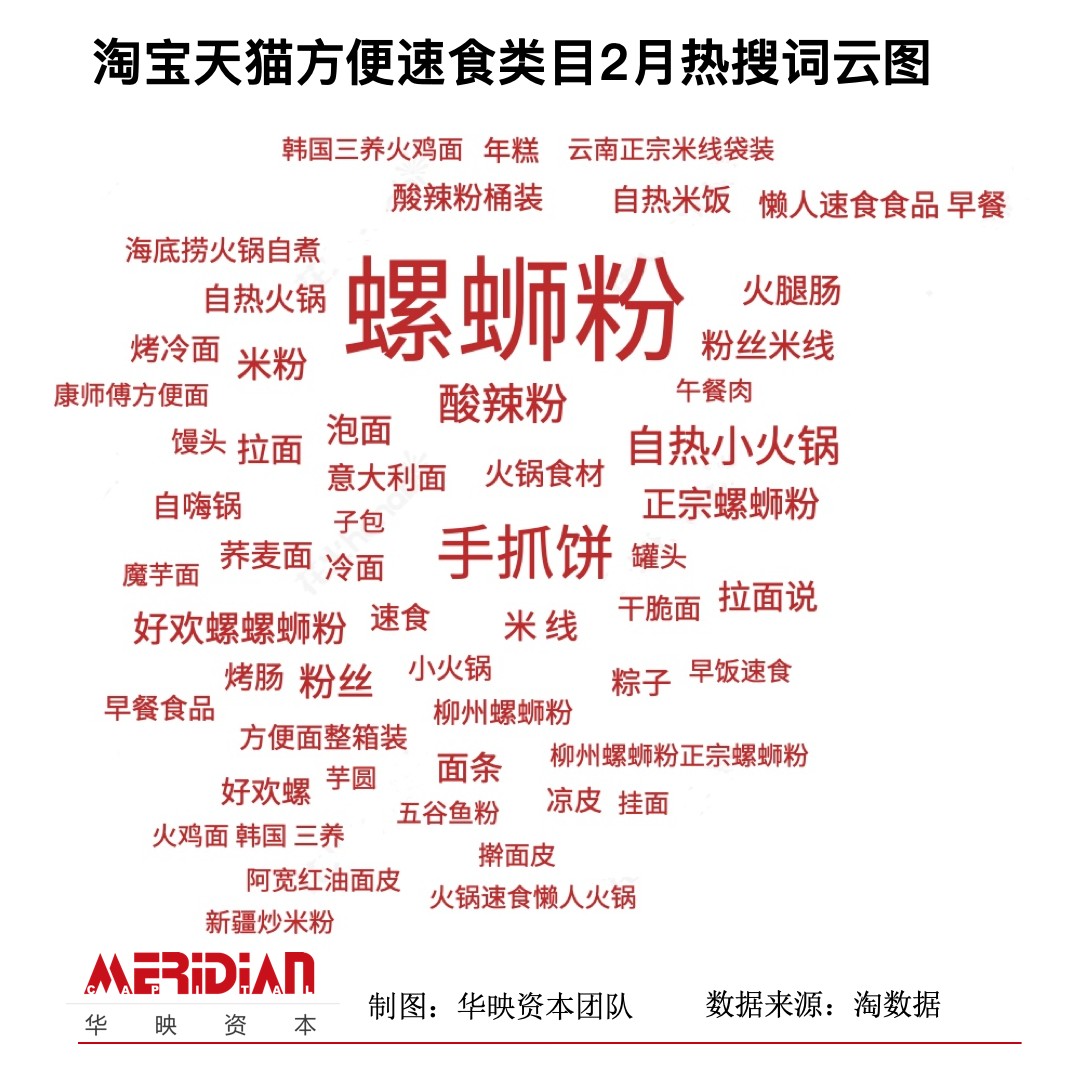

Offline, instant noodles and frozen foods in supermarkets are often out of stock or even empty cabinets. Online, the overall sales volume of instant food on Tmall has increased by nearly 700% year-on-year since February. The special scene under the epidemic situation has amplified the demand and accelerated the rise of instant food in recent two years.

As the investor of the head brands in the two categories of snail powder and self-heating hot pot, Huaying has insight in this issue. We want to talk about the ups and downs of the convenient fast food industry and count the shining points and investment opportunities of the star categories.

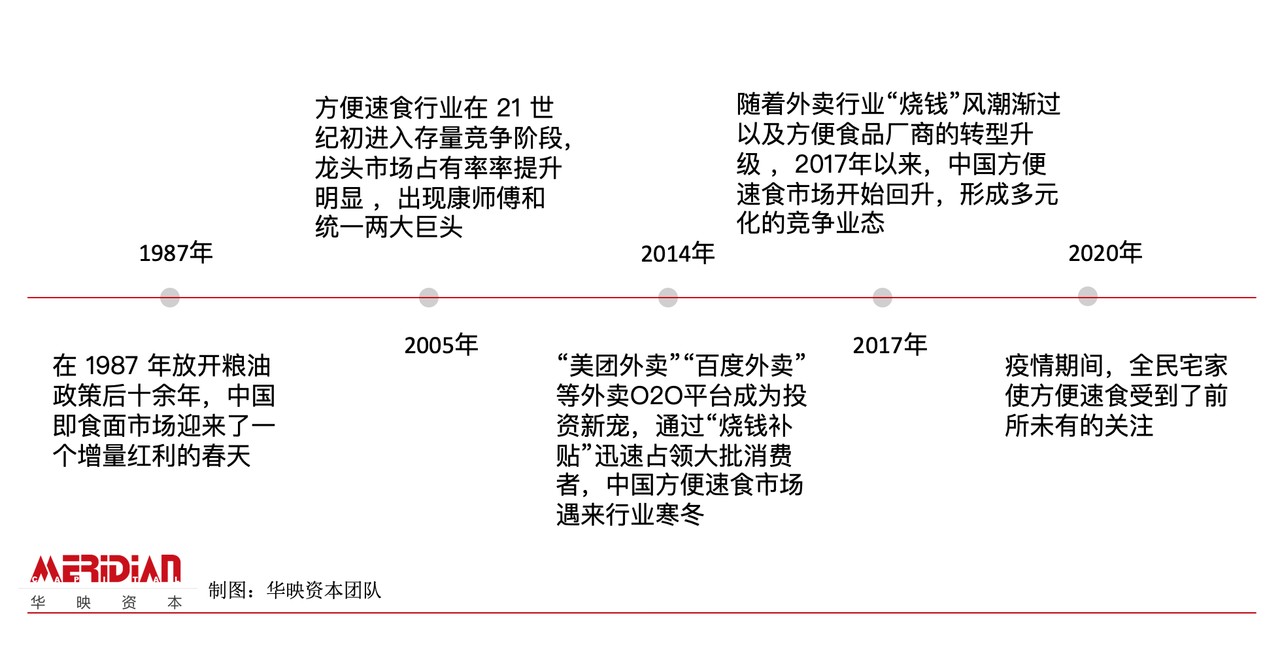

Instant noodles used to be the soul of rental houses, standard in Internet cafes and necessary for travel. We have all experienced the classic "braised beef noodles era" to some extent. Subsequently, it was impacted by healthy eating habits and take-away, and then it made a comeback in recent years, becoming more and more high-end, healthy and diversified. The development process of convenient fast food industry can be described as ups and downs.

Development map of instant food industry

In recent years, with the increasing trend of consumption upgrading, the giants in the fast food industry have seized the opportunity to launch more and more healthy, delicious and personalized products. For example, the zero-fat soup vermicelli series and the self-heating noodle restaurant series launched by Master Kong; Unified launch of Tang Daren series and self-heating life house series.

At the same time, a large number of online celebrity brands and cutting-edge brands cater to the consumption needs and preferences of young people, and help brands break through successfully with marketing innovation and product innovation. Such as the star with the same paragraph, film and television drama implantation, and "half of the entertainment circle is eating"; Lamian Noodles, which co-branded with Fire Hidden Ninja and focused on specific consumer groups, was launched.

In addition, traditional offline restaurants also carry out online layout, such as self-heating hot pot launched by Haidilao; Lazy instant hot pot launched by Dezhuang, etc. Convenient fast food family products have appeared from generation to generation, and have won the fans of many consumers.

Marketing innovation and product innovation of convenient and fast food

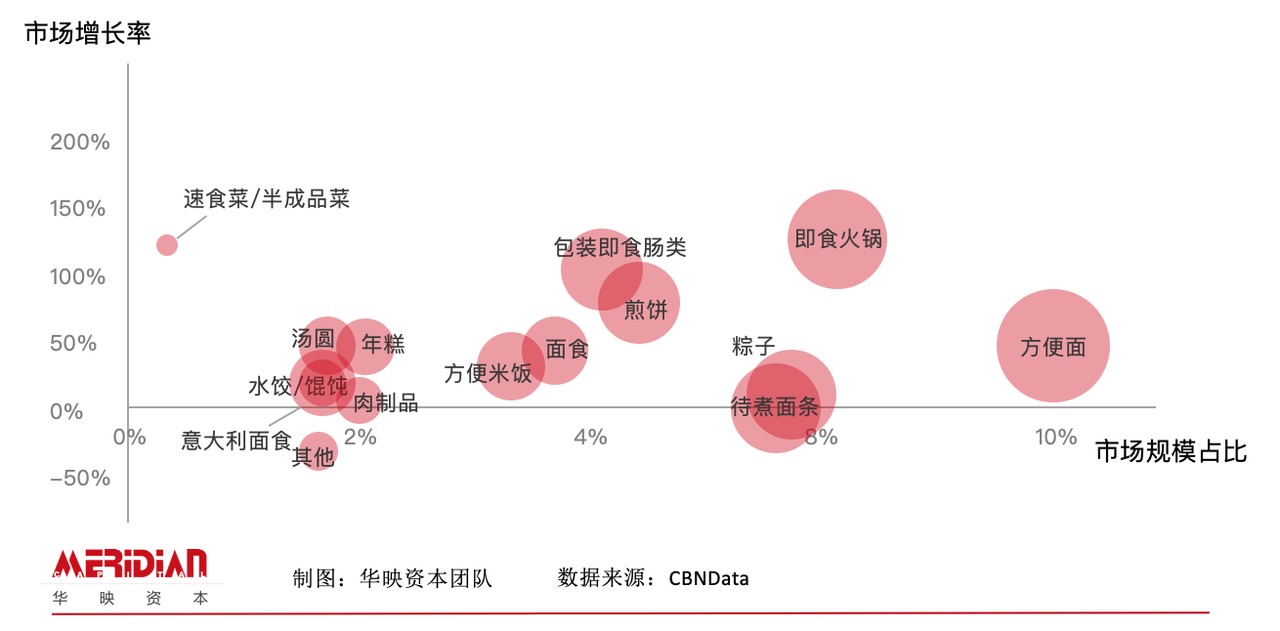

Up to now, the instant food family has grown stronger and stronger, including all kinds of instant noodles/rice, dumplings and wonton, glutinous rice cakes, instant soup/porridge, instant hot pot, seafood balls, noodles to be cooked, semi-finished dishes and so on. Healthy fast food and Tiannanhaibei special food are in full swing, and Regan Noodles, snail powder, spicy incense pot and other convenient fast food products with new flavors emerge one after another. The sales position has also expanded from the traditional supermarket convenience to online channels including Taobao JD.COM micro-store, and has been combined with emerging channels such as B2C fresh e-commerce, pre-warehouse, and supermarket arrival.

Proportion and growth trend of market size of various sub-categories of instant food in 2019

In 2018, the national convenience food manufacturing enterprises completed the main business income of 294.01 billion yuan, a year-on-year increase of 5.2%. In the past three years, the consumption scale of online convenient fast food has continued to expand, and the consumption scale of MAT2019 Taobao convenience fast food industry has increased by 106% compared with MAT2017.

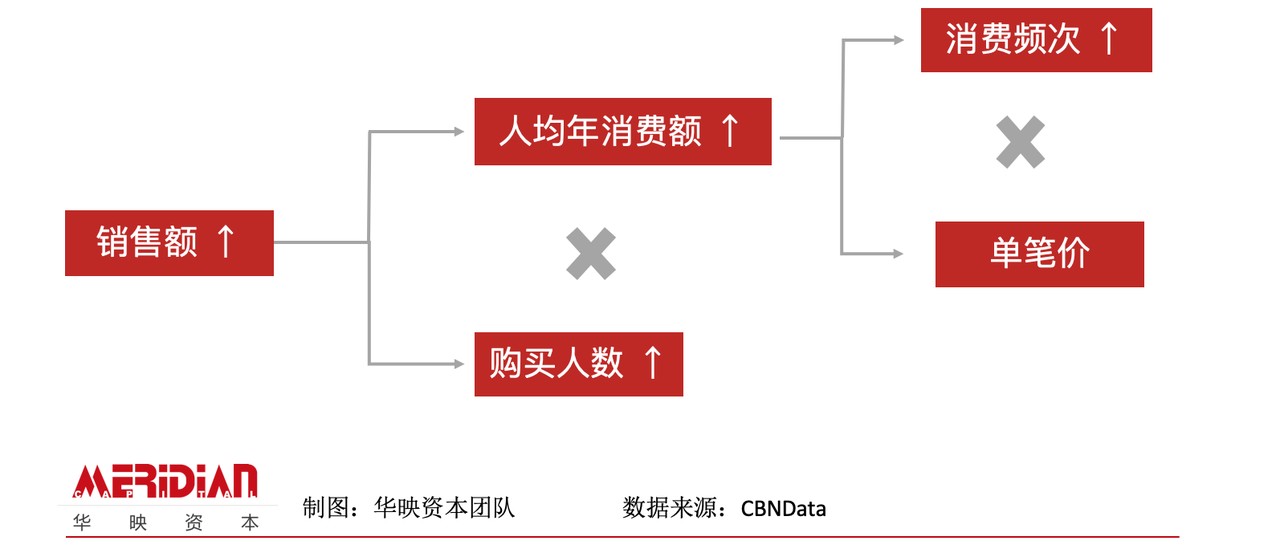

According to public data, instant food has become a 250 billion-level big market. The double growth of consumer population and consumption frequency has promoted the continuous expansion of the convenient and fast food industry. According to the composition of sales growth, in 2019, the number of instant food buyers in Taobao channel increased by 126% year-on-year, the frequency of consumption increased by 6%, and the single price also increased continuously, jointly boosting the expansion of the instant food track.

Disassemble the growth driving force of convenient fast food industry

During the epidemic, the convenience and fast food of the whole family received unprecedented attention. Master Kong’s instant noodles almost run out in the terminal stores, which can reach the rhythm of "noodles don’t fall to the ground" during the operation process (that is, instant noodles arrive at the dealer’s warehouse and are directly robbed by wholesalers and stores before they are put into storage); The online order volume of self-contained pots on platforms such as JD.COM Supermarket and Tmall Supermarket has increased by 2-3 times; A number of snail powder brands are in short supply, and the pre-sale system is fully opened, and the delivery is even scheduled for May ………………………………………………………………………………………………………………………………

During the Spring Festival and the epidemic, the whole network of convenient and fast food was popular. Although the time point was special, it was no accident that it returned to consumers’ field of vision. We summarized the following boosting factors from the perspectives of crowd, scene and marketing:

1. Crowd: With the rise of the new generation, the demand and acceptance of new and exotic products have increased. The post-80s office group and the younger generation of consumers, represented by the post-90s and the post-00s, have become the mainstream consumers, and their consumption needs are increasingly diversified and personalized, and they are willing to accept new things.

2. Scenario: "Lazy economy" and "one-man economy" have created more application scenarios for convenient fast food. From self-cooking to ordering in restaurants, from ordering takeout to hoarding convenient fast food, every kind of consumption behavior is one step closer to laziness. The fast-paced urban life has changed people’s living conditions, and dining in groups of three or five is often not the first choice for everyone to relax.

3. Products/channels: The trend of catering retailing is strengthened, which not only solves the problem of offline stores, but also enriches fast food and prolongs the consumption life cycle. In recent years, self-selling related agricultural and sideline fast food products have increasingly become the regular configuration of brand catering stores. For example, the platform party, Daily Youxian, has also joined forces with catering enterprises such as Xibei, Meizhou Dongpo and Xiaonanguo to launch "famous dishes", and delivered standardized signature dishes to the home from the pre-warehouse of Daily Youxian after vacuum packaging and rapid freezing.

4. Marketing: People’s consumption habits are more and more inclined to browse and plant grass, pay attention to the tidal nature of consumer goods, and KOL//star bring goods to help facilitate fast food. In addition to the joint-name models and film and television variety implants mentioned in the previous article, the food IP has become more and more vital. In February of this year, Liziqi brand snail powder sold over one million copies; Kenny Lin, Hua Chenyu and other bloggers recommended self-heating hot pot, which made more and more consumers pay attention to the new category of convenient and fast food.

For overseas markets, convenient fast food brands also use various ways to reach out, ranging from Li Ziqi’s influence through IP, to the laying of terminal channels or the cultivation of consumption habits along the line. For example, at present, Jinmailang has spread the noodles of Laofanjia into the shelves of chain convenience stores in Japan and South Korea, and Master Kong has also opened the Express Express Express noodle restaurant on the Swiss special train.

The epidemic situation has further boosted the above trend, which is convenient for the fast food track to usher in a growing spring. Among them, snail powder and self-heating hot pot have become typical hot categories in the recent instant food. The former is the representative of the rise of local specialty food, while the latter is a rookie in the innovative category. During the Spring Festival, it surpassed cherries and quick-frozen dumplings, occupying the current two hot-selling foods in Taobao, and people who eat melons have pursued "snail powder freedom" and "self-heating hot pot freedom".

How hot is snail powder?

From February 5th to March 6th, according to the cloud and data, there were ten hot searches in Weibo on topics related to "snail powder", and the cumulative reading volume of Weibo topics exceeded 2 billion.

Taobao announced that the online pre-sale period of snail powder was scheduled for April, and the offline merchants were snapped up early. The snail powder of Liziqi flagship store sold 1 million+in February. 60 million people in Weibo called for the freedom of snail powder, 3.2 million people relied on snail powder to satisfy their cravings, and snail powder takeout in office buildings rose by 58%.

Snail powder lowers the threshold of trying by spreading heat, and has strong taste memory and addiction, and its popularity is similar to that of spicy strips. In 2018, more than 60,000 snail powder online stores were opened on various platforms. Last year, Guangxi sold more than 28.4 million pieces of snail powder, beating the long-established local snacks such as roasted cold noodles, Regan Noodles and handmade noodles to become the most popular food. In the ten years from 2010 to 2019, the related orders of snail powder soared by more than 9230 times, occupying the forefront of "new urban specialties".

Among the TOP10 brands of snail powder sales, Liziqi, Haohuanluo, Daohuaxiang and Xixiluo will occupy half of the market share of the whole snail powder industry. At present, the sales of each product range from 0.2 million/200 thousand to 1 million+,and most of them are out of stock. The estimated delivery time of the flagship store is even in early May. The surge in sales puts higher demands on production capacity, and brands with long-term accumulation in the supply chain are more likely to win.

Self-heating hot pot, as its name implies, is a hot pot that can be cooked by adding cold water without firing or using electricity. Searching for the keyword "self-heating chafing dish" or "instant chafing dish" on Taobao will pop up nearly 5,000 items, with prices ranging from 20 yuan to 50 yuan.

As an innovative category, self-heating hot pot has been escalating in recent years. During the Double Eleven in 2019, the self-contained pot sold 5 million barrels through 165 hours of live broadcast, ranking first in the category. Cutting-edge brands such as Mo Xiaoxian, a self-proclaimed pot, are eye-catching, and well-known hot pot chain brands such as Haidilao Xiaolongkan Dalongyi are also laid out.

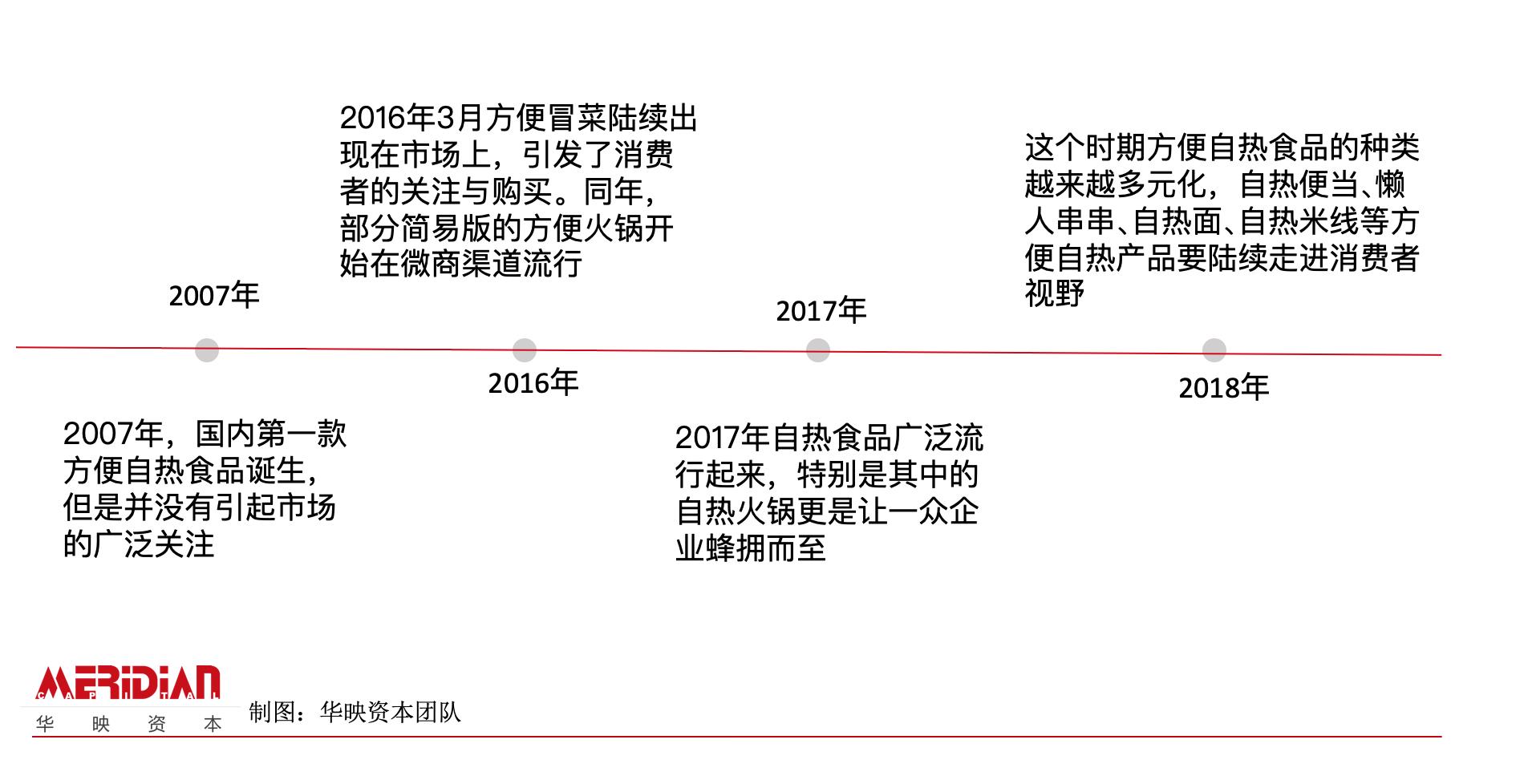

Self-heating food was used as a "hard core" at the beginning of its birth: it was first used as a part of field rations abroad, mostly for the military. However, the development of self-heating food in China in recent years has gone through three stages: the germination and the outbreak of categories in more than ten years:

The rise of self-heating food largely comes from the popularity of self-heating hot pot. According to the research report of GF Securities, the market scale of the self-heating hot pot industry will reach 5-15 billion yuan in the next 5-7 years, with a compound annual growth rate of 40%-60% in the rapid development stage of the industry, and the potential is still being released.

Objectively speaking, the epidemic has promoted the transformation of self-heating food from online celebrity to daily consumer goods. In the early days, the brand of self-heating hot pot seized consumers’ exploration of new and exotic products through the comprehensive implantation of entertainment stars’ film and television dramas and the recommendation of little red books, hoping to become a "online celebrity explosion" and open the brand and category popularity in a short time. When the consumption habits are further developed, after the only way from niche to Pratt & Whitney, next, brands will enter the competition in terms of the stability of production technology supply chain, online and offline channel capabilities, ?SKU expansion capabilities and so on.

Undoubtedly, the epidemic has stimulated consumers’ hoarding demand for essential consumer goods in the short term. Is it sustainable in the long run? Where is the breakthrough road of convenient and fast food? What’s the trend? What are the characteristics of the brand worthy of optimism? The following are our thoughts from the perspective of investment.

Q1: After the epidemic has passed, can instant food continue to be popular?

"During the epidemic, everyone was forced to stay at home, prompting more and more people to choose online shopping to facilitate fast food. Fast food, which relies on the growth of the Internet e-commerce platform, has especially ushered in a concentrated outbreak. " Cai Hongliang, the founder of the pot, believes that the logic of market consumption still exists in the long run. In 2018, the catering industry in China has entered the 4 trillion mark, among which the young "lazy homebodies" are exploding with great consumption potential. China consumers who have experienced "consumption upgrading" and imported food education have become more and more mature. The expansion and upgrading trend of the instant food market in recent years does not take the short-term impact of the epidemic as a shift.

At the same time, Jiang Zhifeng, senior investment director of Huaying Capital, also mentioned that "the substitution of packaged food for restaurant food under the epidemic situation has accelerated the retail trend of catering, and more and more people are pursuing packaged food that can achieve the taste and quality of restaurant food with strong upgrading attributes". New categories are making up for some gaps in the past catering industry and lowering the educational threshold for consumers. For example, as mentioned above, the epidemic situation has promoted the transformation of self-heating food from online celebrity to daily consumer goods.

Q2: What stage has the instant food industry reached as a whole? What will happen in the future?

The convenience and fast food industry has transitioned from the incremental stage to the value promotion stage, which has become a common view in the industry. For example, the high-end transformation of instant noodles in the past two years has effectively promoted the growth of subdivided tracks and facilitated the recovery of the fast food market, which is the result of the continuous innovation and upgrading of the consumer side.

In the future, the convenient and fast food market will continue to grow, and there will be a polarization trend: the mass market will continue to pursue cost performance, and the high-end market will put forward higher requirements for taste and quality; One is the mass path of "a good life is not so expensive", and the other is the boutique path of "paying a premium for a good life". In the end, from niche to Pratt & Whitney is still the only way for most consumer brands, and we are more optimistic about the categories with high ceilings and potential to become national food.

Q3: What capabilities does a convenient fast food brand need? What kind of brand is worth optimistic about?

Cao Xia, director of Huaying Capital, said, "Huaying’s screening criteria in the layout of self-heating convenient fast food tracks are as follows: the market segment is large enough and the SKU is extensible; Product differentiation, focusing on user needs and quality improvement; The ability of founders and teams in product channels and other aspects. " For convenient fast food brands, it is necessary to keep open to the iteration of market and consumer demand and embrace the changes in online traffic organization; At the same time, it accumulates the stability advantage in the production end of supply chain logistics.

In the past 18 years, the fastest-growing fast food track is the product with high customer unit price, which means that everyone is willing to pay better prices for better products. In addition, consumers pay more and more attention to healthy ingredients and techniques, and convenient fast food without additives will be more popular. The trend of fast food/healthy catering retailing deserves special attention.

Convenient fast food is experiencing the horizontal expansion and vertical iteration of categories, and the epidemic will further push the new generation of fast food products such as snail powder and self-heating hot pot into the public’s field of vision. Even consumer brands that subdivide categories for segmented people should continue to seek large-scale growth. The way out of the circle of convenience food during the epidemic period is of great significance to its future development. We are optimistic about the growth of convenience fast food track for a long time, and expect more updated sub-categories to break out further.

[Reference]

FBIF food and beverage innovation "Hot search 300 million, annual sales of 10 billion, why is snail powder so" top "? 》

Retail krypton planet "Sorry, apart from online and convenient fast food, there is no new story about fresh retail in the epidemic? 》

Business Weekly | The Rise of Convenience Food under the Epidemic Situation

Tmall -2019 Online Instant Food Industry Trend Insight Report

Guojin Securities-Interpretation of February Consumption Data: "Home" Economy Emerged in Special Period

CITIC Jiantou Securities-"Nissin Food: the pioneer of high-quality instant noodles with steady growth"

This article is published by Entrepreneurial State authorized by the columnist, and the copyright belongs to the original author. The article is the author’s personal opinion and does not represent the position of the entrepreneurial state. Please contact the original author for reprinting. If you have any questions, please contact editor@cyzone.cn.