Global Wealth Report: The average wealth of adults in China is 158,000 yuan.

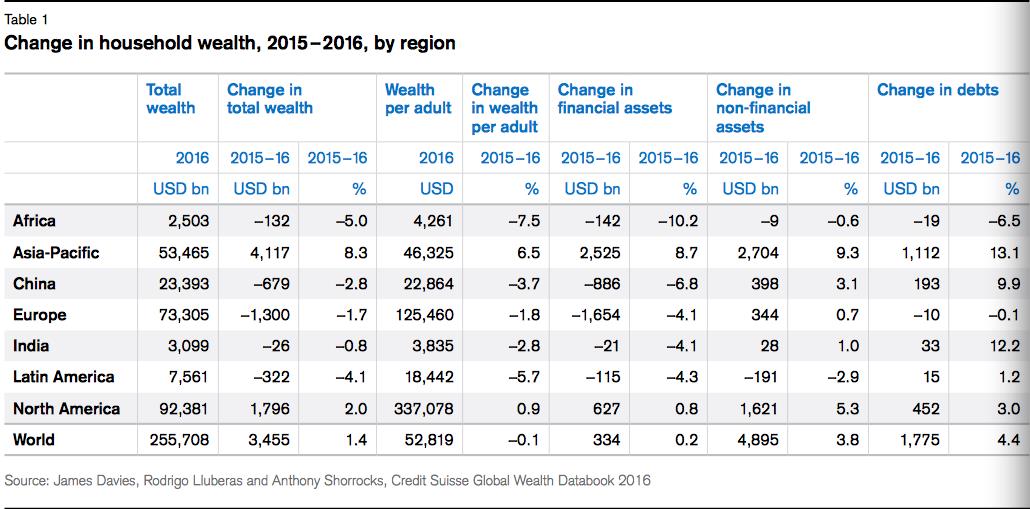

Just as the rapid depreciation of the RMB against the US dollar has just been suspended for 12 consecutive days, the latest 2016 Global Wealth Report released by Credit Suisse Research Institute shows that the overall family wealth in China in 2016 shrank by 680 billion US dollars to 23.393 trillion US dollars, down 2.8% from last year; The average wealth of adults was $22,864 (about RMB 158,000), a year-on-year decrease of 3.7%.

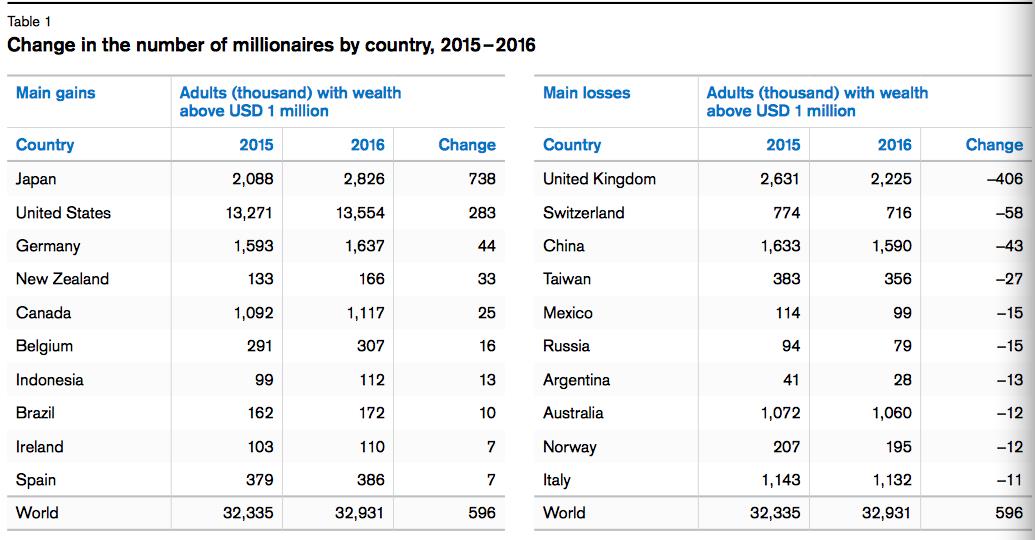

At the same time, the number of millionaires in China (with a wealth of more than $1 million) has not increased, but ranks in the forefront of the decline list of millionaires, with a decrease of 43,000.

According to the above report, since 2000, the number of ultra-high net worth individuals (with net assets exceeding $50 million) worldwide has increased by 216%. Among them, the number of ultra-high net worth individuals in China increased 100 times, reaching 11,000 in 2016, an increase of 640 places over last year, ranking second in the world, second only to the United States, accounting for 9% of the total number of super-rich people in the world, and second only to the United States.

However, compared with the rapid growth of the number of super-rich people in China, the following information may be more worthy of attention.

China’s family wealth has shrunk by $680 billion.

In the past year, the fastest growth of overall household wealth was not in the United States, nor in China or India where GDP growth was soaring, but in Japan.

The above-mentioned Global Wealth Report shows that although American household wealth has increased by 1.7 trillion US dollars, the most striking performance is Japan, which has increased by 3.9 trillion US dollars, far exceeding other countries in the world. Germany ranked third, while France, Canada, New Zealand, Indonesia and Brazil also increased by 100 billion US dollars respectively.

Changes in household wealth in various regions of the world in 2016 (Source: Credit Suisse Global Wealth Report)

No matter how fast the number of rich people in China is growing, in 2016, China’s overall wealth has shrunk by 680 billion US dollars, ranking second in the list of shrinking wealth in the world, second only to Britain.

Credit Suisse believes that the main reasons for China’s shrinking wealth are the adjustment of equity prices and currency depreciation. The most serious shrinkage of 1.5 trillion US dollars (down 10%) in Britain is the direct result of the referendum on Brexit.

Except for the growth of Japan and the obvious shrinkage of China and Britain, the wealth of other countries has changed relatively smoothly. Japan’s household wealth increased by 3.9 trillion US dollars, up 19% year-on-year, mainly due to the strong appreciation of the yen.

The number of millionaires in China decreased by 43,000 last year.

According to the Global Wealth Report, in 2016, the number of rich people with a wealth of more than one million dollars showed significantly different performances in different countries. Among them, the number of millionaires in Japan grew the fastest, with an increase of 738,000 in 2016, reaching 2.826 million. The United States is still the country with the largest number of millionaires in the world. In 2016, there were 13.554 million people, an increase of 283,000. The third fastest growing country is Germany, but the overall number is behind Britain and China.

But unfortunately, Britain and China continue to rank in the list of declining rich people. Among them, the situation in Britain is still the most serious. In 2016, the number of millionaires decreased by 406,000, reaching 2.225 million; Followed by Switzerland, which decreased by 58,000 to 716,000; China, which ranked third, decreased by 43,000, from 1.633 million in 2015 to 1.59 million.

Changes in the number of millionaires in various countries in 2016 (Source: Credit Suisse Global Wealth Report)

China accounts for 21% of the world’s adult population and only 9% of its wealth.

According to the above report, 0.7% of adults in the world control 46% of the world’s wealth, while 73% of the population at the bottom of the wealth pyramid have less than $10,000 each, accounting for only 2.4% of the global wealth.

Despite the rapid economic growth in China in recent years, the number of adults in China accounts for 21% of the world’s total, while its wealth accounts for only 9% of the world’s total wealth. This ratio is similar to that in Latin America, where 8% of global adults account for 3% of global wealth. The situation in Africa and India is even more serious.

Excluding China and India, the situation in the Asia-Pacific region is relatively mild, with about 24% of the global adult population owning 21% of the global wealth.

According to the report, since 2000, the global wealth has expanded rapidly in the first few years, which is mainly attributed to the rapid growth of China and other emerging economies. In 2000, the overall wealth of emerging economies only accounted for 12% of the world, but it contributed nearly 25% to global economic growth. Today, emerging economies already have 18% of the world’s ultra-high net worth individuals (with net assets exceeding $50 million), and China alone accounts for 9%, surpassing French, German, Italian and British.

The number of ultra-high net worth individuals in China reached 11,000, 640 more than last year, ranking second in the world after the United States.

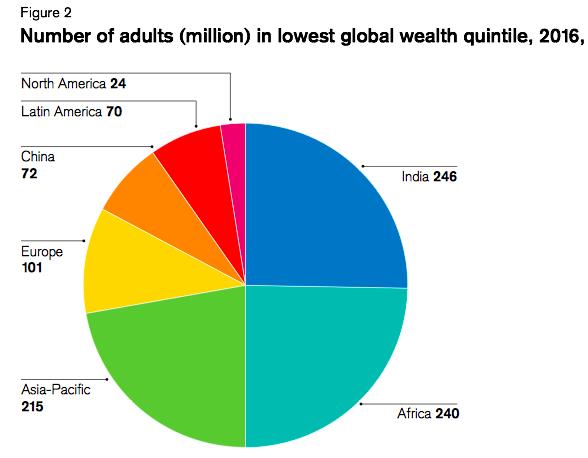

The other extreme of super wealth is extreme poverty. The countries or regions with the largest number of poor people in the world are India and Africa, with 246 million and 240 million people respectively, and the sum of the two is equivalent to half of the global poor population; The Asia-Pacific region except India and China has 215 million poor people, while Europe also has 101 million poor people, surpassing 72 million in China and 70 million in Latin America. There are 24 million poor people in North America.

Distribution of the poorest people in the world (Source: Credit Suisse Global Wealth Report)

The number of millionaires in China will increase by 73% in the next five years.

Credit Suisse predicts that in the next five years, the number of millionaires in China will reach 2.749 million from 1.59 million in 2016, an increase of 73%, surpassing German and French, and rising from the current sixth place to the fourth place. And the growth rate of 73% will also exceed that of any country in the world. However, in terms of the number of millionaires, the United States will remain in the first place, and the number of millionaires will increase from 135.54 million in 2016 to 180 million, an increase of 33%. The second and third places after the United States and before China are Japan and the United Kingdom respectively.

It is worth mentioning that the number of millionaires in India currently ranks 20th in the world, and by 2021, the number of millionaires in India will rise from the current 178,000 to 280,000, an increase of 57%.

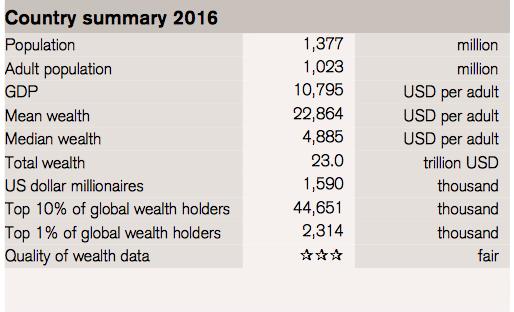

According to the above report, from 2000 to 2016, China’s personal wealth grew relatively strongly, from $5,670 to $22,864. Although the global wealth fell by 20% due to the financial crisis, it quickly recovered to the level before the financial crisis. In 2016, China’s adult population totaled 1.023 billion, and its per capita GDP was 10,795 US dollars (about 75,000 yuan).

Overview of China’s per capita wealth in 2016 (Source: Credit Suisse Global Wealth Report)

In terms of overall family wealth, China currently ranks third in the world, next only to the United States and Japan. In the past year, real estate performed better than the stock market, so the growth rate of non-financial household assets in 2016 increased by 53% from 50% in 2015.

Private houses and rural land are important forms of wealth in Chinese, and the per capita fixed assets owned by adults in China are equivalent to 13,100 US dollars (about 90,000 yuan). In addition, the per capita debt level is about $2,100 (about RMB20,000), accounting for 8% of the total assets. Although it is still relatively low, personal debt has increased significantly in recent years.

Editor:Guxiang town