Notice of the Ministry of Finance on Printing and Distributing the Provisions on the Connection between the New and Old Accounting Systems of Village Collective Economic Organizations

On December 13, 2004, Cai Shui [2004] No.21

Relevant ministries and commissions of the State Council, relevant directly affiliated institutions, finance departments (bureaus) of all provinces, autonomous regions, municipalities directly under the Central Government and cities under separate state planning, and Finance Bureau of Xinjiang Production and Construction Corps:

In order to do a good job in the convergence of the implementation of the "accounting system of village collective economic organizations" by village collective economic organizations, the provisions on the handling of the convergence of the old and new accounting systems of village collective economic organizations are hereby printed and distributed to you, please follow them. If there are any problems in the implementation, please feedback to our department in time.

Annex: Provisions on the connection between the new and old accounting systems of village collective economic organizations

Attachment:

New and old accounting systems of village collective economic organizations

Provisions on the handling of convergence problems

The accounting system of village collective economic organizations (hereinafter referred to as the new system) has been implemented in the national village collective economic organizations since January 1, 2005, and the accounting system of village cooperative economic organizations (for Trial Implementation) issued by the Ministry of Finance in 1996 (hereinafter referred to as the original system) shall be abolished at the same time. In order to do a good job in the connection between the old and new systems, the provisions on the connection between the implementation of the new system by village collective economic organizations are as follows:

First, do a good job of preparation before account reconciliation.

Before December 31st, 2004, the village collective economic organizations should still conduct accounting and compile accounting statements according to the original system, and conscientiously do a good job in the year-end closing and year-end final accounts distribution in 2004 according to the requirements of the original system. Since January 1, 2005, village collective economic organizations should strictly implement the new system, set up accounts according to the new system, transfer the year-end balance of each accounting subject in 2004 to the new account and make adjustments, and then use it as the year-end balance of each accounting subject in the new system, and prepare the balance sheet at the beginning of 2005 according to the new system.

Village collective economic organizations shall conduct a comprehensive inventory of the assets and liabilities of their own units before the final accounts in 2004, and after the assets found in the inventory are scrapped, damaged, overaged and deficient, they shall debit "other expenses" or credit "other income" and credit or debit related assets. If there are assets that should be confirmed but not accounted for, the village collective economic organization shall, according to the provisions of the new system from January 1, 2005, and after the approval of the prescribed procedures, debit the relevant assets and credit the "public welfare fund" account; If there are liabilities that should be confirmed but not recorded, after the approval of the prescribed procedures, debit "income distribution?" ? Undistributed income "account, credited to the relevant liability account.

Two, the old and new accounting subjects carry forward

The village collective economic organization shall, on the basis of the above-mentioned assets verification, directly transfer the balance of relevant subjects to the new account or continue to use the old account.

Asset class

(a) "cash", "bank deposits", "receivables", "internal transactions" and "fixed assets liquidation" subjects.

The new system has set up the accounts of cash, bank deposit, receivables, internal transactions and fixed assets clearing, and its accounting contents are basically the same as those of the corresponding accounts in the original system. When reconciling accounts, the balance of the above subjects in the original account should be directly transferred to the corresponding subjects in the new account or the old account should be used.

(two) "inventory" and "finished goods" subjects.

The new system does not set the account of finished goods, but sets the account of inventory materials, and its accounting content includes two accounts of inventory materials and finished goods in the original system, as well as some accounts of operating expenses in the original system. During account reconciliation, a detailed account should be set in the new account "Inventory Materials" according to the name of the inventory materials, and the balance of the original account "Inventory Materials" and "Finished Goods" and the balance of the industrial products that have been completed and put into storage but not yet sold in the original account "Operating Expenditure" should be transferred to the corresponding detailed account of the new account "Inventory Materials".

(3) subjects of "short-term investment" and "long-term investment"

The new system has set up "short-term investment" and "long-term investment" subjects, and its accounting content is different from the original system. When the account is reconciled, the balance of "short-term investment" and "long-term investment" in the original account shall be analyzed:

1, the original account of "short-term investment" subjects, such as the balance of escrow funds deposited in the township (town) and village rural cooperative funds, should be transferred to the new account of "accounts receivable" subjects; Transfer the remaining amount to the new account "short-term investment".

2, the original account of "long-term investment" subjects, such as monetary funds to join the township (town), village rural cooperative foundation and the term of more than one year, should be transferred to the new account of "accounts receivable" subjects; Transfer the remaining amount to the new account "long-term investment".

(four) "fixed assets", "accumulated depreciation" and "construction in progress" subjects.

The new system sets up the subjects of fixed assets, accumulated depreciation, construction in progress, livestock (poultry) assets and forest assets, and the accounting contents of fixed assets and construction in progress are different from the original system. When the account is reconciled, the balance of the original account "fixed assets", "construction in progress" and related asset accounts shall be analyzed:

1, the original value of the original account of "fixed assets" accounting after deducting the accumulated depreciation of the original account of "accumulated depreciation" accounting, transferred to the new account of "livestock (poultry) assets" subject belongs to "livestock" secondary subjects.

2. The original value of economic trees accounted for in the original account of fixed assets is deducted from the accumulated depreciation of economic trees accounted for in the original account of accumulated depreciation, and transferred to the second-level account of economic trees in the new account of forest assets.

3, the original account "construction in progress" and other subjects accounted for the cost of non-economic trees and the cost of economic trees that have not yet been put into production, respectively, into the new account "forest assets" subject belongs to the "non-economic trees" and "economic trees" two subjects; Transfer the remaining amount to the new account "Construction in progress".

4. Transfer the balance of the original account "accumulated depreciation" to the new account "accumulated depreciation" after deducting the above-mentioned accumulated depreciation of L and 2 middle-class draught animals and economic trees.

The new system improves the recognition standard of fixed assets, and when adjusting accounts, it is handled according to the principle of "old problems and old methods, new problems and new methods". Fixed assets that have been recorded in the original account but are lower than the confirmation standard of the new system will not be adjusted during account reconciliation; The newly purchased fixed assets shall be accounted for according to the standards stipulated in the new system.

(five) "other assets" subjects.

"Other assets" is not set in the new system. When the account is reconciled, the balance of other assets in the original account shall be analyzed:

1. If there is any balance in the second-level account of intangible assets in the original account, the second-level account of intangible assets in the original account should be added, and the balance of the second-level account of intangible assets in the original account should be directly transferred to the new account.

2, the original account of "other assets" belongs to the "deferred assets" secondary account balance in line with the provisions of the new system of assets, transferred to the new account of assets; For deferred assets that do not meet the requirements of the new system assets in the original account, after being approved by the prescribed procedures, the account of "income distribution-undistributed income" shall be debited and the account of "other assets-deferred assets" shall be credited.

3, for the balance of the original account "other assets" belongs to the "other long-term assets" secondary subjects, should be transferred to the new account related assets according to the actual situation.

Liabilities

(six) "short-term loans", "accounts payable", "welfare payable" and "long-term loans and accounts payable" subjects.

The new system has set up the subjects of "short-term loan", "payable", "welfare payable" and "long-term loan and payable", and its accounting contents are basically the same as those of the corresponding subjects in the original system. When reconciling accounts, the balance of subjects above the original account should be directly transferred to the corresponding subjects in the new account or the old account should be used.

(seven) "wages payable" subjects

The new system sets up the subject of "Payable Wages", which is used to calculate the remuneration payable by village collective economic organizations to their managers and regular employees. During account reconciliation, if the village collective economic organization has unpaid remuneration to its managers and regular employees, it should transfer the balance of wages payable that has been recorded in the relevant subjects of the original account to the new account "wages payable".

(eight) the subject of "one thing, one discussion fund"

The new system has set up the subject of "one case, one discussion fund", which is used to calculate the special funds raised by the village collective economic organizations for the establishment of production and public welfare undertakings after the reform of rural taxes and fees. When adjusting accounts, the balance of funds that have been recorded in the relevant subjects of the original account should be transferred to the new account of "funds for one thing and one discussion".

Owner’s equity class

(nine) "capital", "income" and "income distribution" subjects.

The new system has set up the subjects of "capital", "income this year" and "income distribution", and its accounting contents are basically the same as those of the corresponding subjects in the original system. When reconciling accounts, the balance of subjects above the original account should be directly transferred to the corresponding subjects in the new account or the old account should be used.

(ten) "provident fund" and "public welfare fund" subjects.

The new system does not set up the subjects of "provident fund" and "public welfare fund", but it does set up the subject of "public welfare fund", and its accounting content includes the accounting contents of the two subjects of the original system. When the account is reconciled, the balance of the original account "provident fund" and "public welfare fund" should be transferred to the new account "public welfare fund".

Cost category

(eleven) "production (labor) cost" subject.

The new system sets up the subject of "production (labor) cost", which is used to calculate the production costs and labor costs of village collective economic organizations directly organizing production or providing labor services to the outside world. During account reconciliation, the debit balance of the original account "operating expenses" should be analyzed, and the balance of the production expenses of industrial products, agricultural products (such as winter wheat expenses, fish storage expenses in ponds, etc.) and labor costs that have been recorded in the original account "operating expenses" should be transferred to the new account "production (labor) costs".

Profit and loss category

(twelve) "operating income", "contracting and handing in income", "other income", "investment income", "management expenses" and "other expenses" subjects.

Since there is no balance at the end of the year in the profit and loss accounts above the original account, it is not necessary to adjust the account. Since January 1, 2005, the profit and loss accounts should be set up according to the new system for accounting treatment.

(thirteen) "operating expenses" subjects

The new system has set up the subject of "operating expenses", but the accounting content is different from the original system. When reconciling accounts, if there is a debit balance in the "operating expenses" account carried forward from the original account, the debit balance shall be reconciled:

Transfer the balance of the purchase cost and feeding expenses of the young and fattening animals accounted for in the original account of "operating expenses" to the second-level account of "young and fattening animals" in the new account of "livestock (poultry) assets"; Transfer the balance of industrial products that have not been sold after the completion of the accounting of the original account "operating expenses" to the corresponding detailed account of the new account "inventory materials"; Transfer the balance of various production expenses (such as the production expenses of industrial products, the winter wheat expenses that should be carried forward to the next year, the expenses of keeping fish in the pond, etc.) and labor costs incurred by the village collective economic organizations directly organizing production or providing labor services to the outside world to the new account "production (labor) costs".

Under the new system, the "operating expenses" account only for the actual expenses incurred by village collective economic organizations due to activities such as selling commodities, agricultural products and providing services to the outside world. After account reconciliation, there should be no balance at the end of this account.

(fourteen) "retained as a whole income" subjects

According to the new situation after the reform of rural taxes and fees, the new system cancels the subject of "retaining and coordinating income".

(fifteen) "agricultural tax additional return income" and "subsidy income" subjects.

The new system has set up the subject of "agricultural tax additional return income", which is used to calculate the agricultural tax additional, animal husbandry tax additional and other funds returned by the rural (town) agricultural tax collection department received by the village collective economic organizations. Areas that have been exempted from agricultural tax and animal husbandry tax do not use this subject.

The new system has set up the subject of "subsidy income", which is used to calculate the subsidy funds received by the village collective economic organizations from the financial and other relevant departments.

Since there is no balance in the above-mentioned subjects at the end of the year, there is no need for account reconciliation. Since January 1, 2005, corresponding subjects should be set up according to the new system for accounting treatment.

Iii. Accounting statements

balance sheet

The number of items in the column of "balance sheet at the beginning of the year" when the village collective economic organizations implement the new system (that is, at the end of 2005) should be filled in according to the number of items in the balance sheet at the beginning of 2005 compiled according to the provisions of the new system, and the balance sheet of the year when the new system is implemented should be compiled according to the provisions of the new system.

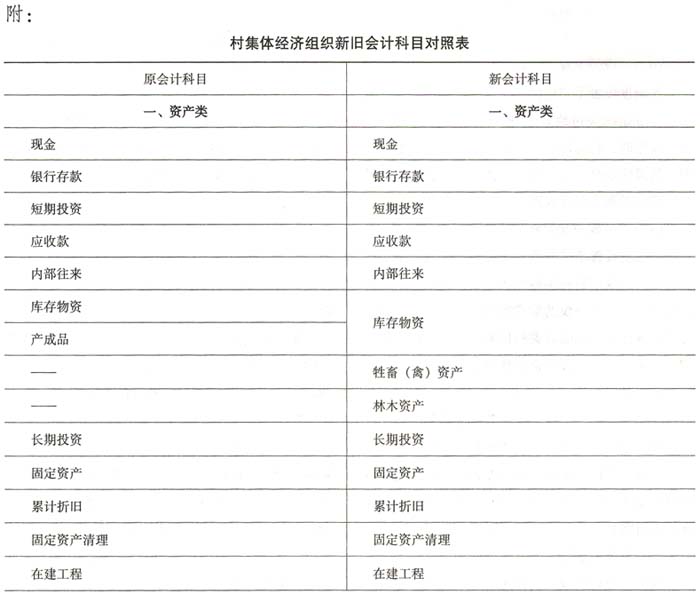

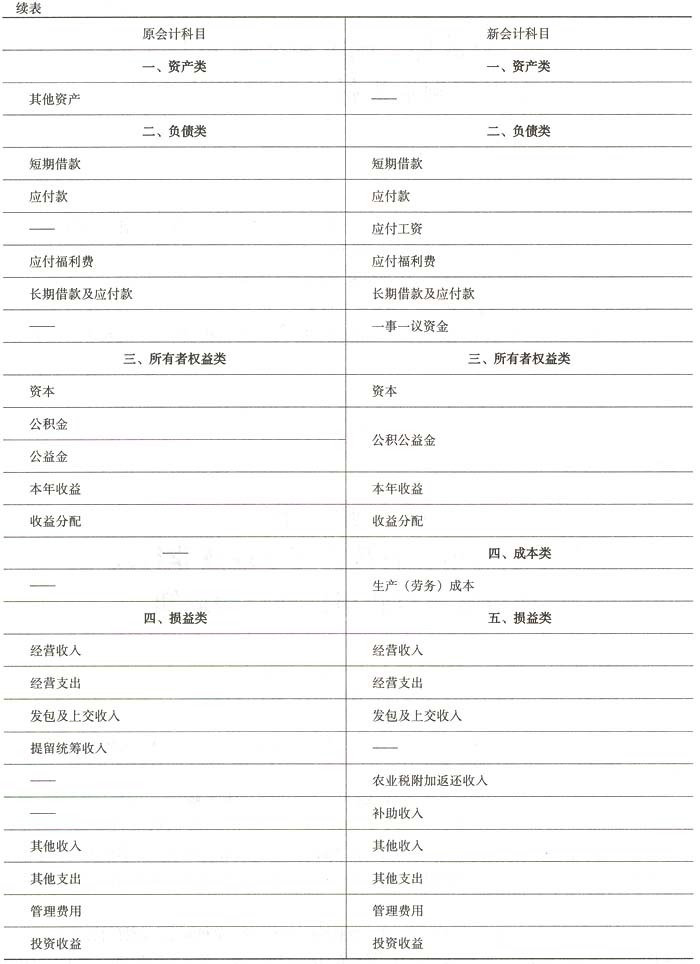

Attachment: Comparison Table of Old and New Accounting Subjects of Village Collective Economic Organizations