Attention! WeChat Alipay is bound to the bank card, and quickly deleted these "photos" in the mobile phone!

At present, many people use WeChat and Alipay to bind bank cards and credit cards. Payment, take-out, movies, taxis ….. are all paid by WeChat and Alipay.

However, while providing convenience, mobile phones also imply many security risks. It’s convenient and easy to draw again, and you can’t save these photos in your mobile phone.

The first photo: the photo of the front and back of the ID card

Some mobile phones download software, which requires real-name authentication of ID card. After our authentication is completed, ID card photos are usually saved on the mobile phone, and they are generally not deleted in time.

Users who often use Alipay should know that when we modify the payment password, we can successfully modify the payment password by selecting the photo on the front of the ID card and SMS verification, so there will be theft, so the photo of the ID card must not be saved in the mobile phone.

Second photo: bank card photo

Since the emergence of mobile payment, we use bank cards less and less frequently, and we are used to binding bank cards with mobile phones for consumption.

When binding a bank card, only the card number and the mobile phone number reserved by the bank can be successfully bound. If the mobile phone is lost, it just happens that there is a photo of the bank card in the mobile phone, which may be stolen by criminals at this time.

The third photo: record the account number and password.

Many people worry that they can’t remember the password, so they will write all this information on a piece of paper and then take photos with their mobile phones. If the mobile phone is accidentally lost, plus photos of the account number and password are recorded, the consequences will be unimaginable.

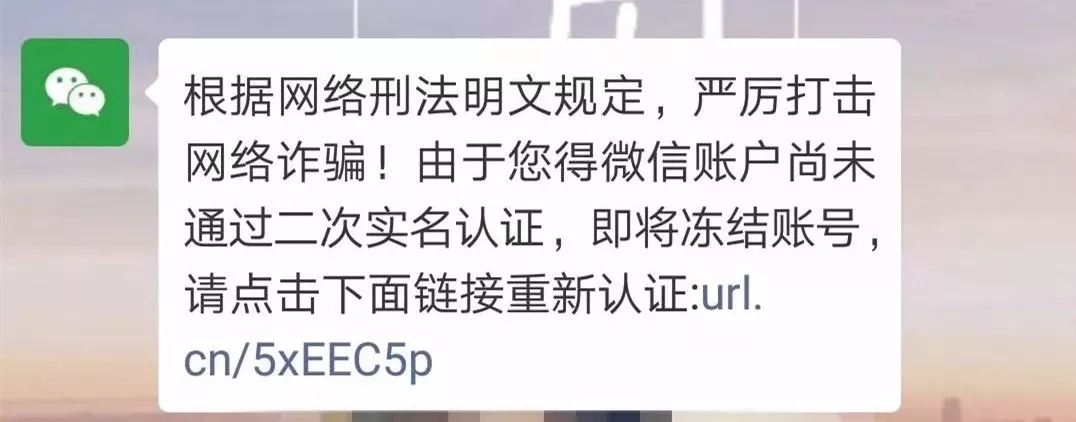

If your WeChat or Alipay receives [your WeChat or Alipay account has not been authenticated for the second time], don’t click on the link!

The second real-name authentication is fake, and it is true that the liar wants to cheat money!

At present, there is no so-called "second real-name authentication" on WeChat. This is a liar who modifies his avatar and name to pretend to be "official" and then sends a phishing link to the user.

Let users fill in the information such as bank card, password and SMS verification code through the fake second real-name authentication link, and induce users to transfer money from the bank card.

If you receive a short message from a "strange number", you may just ignore it or delete it. But if you or your friend’s name appears in the text message, you will definitely open it out of curiosity, and it is such a "point" that your bank card may no longer "belong" to you!

Don’t believe this information either.

I believe many people have received all kinds of scam messages, the most common of which are as follows:

1. This is a photo of the last party. It’s a precious photo. Please have a quick look.

2. Please check your child’s recent comprehensive evaluation results at school and give guidance. I wish you a happy life (attached link).

3. This is your traffic violation record in a certain place on a certain day. Please check it.

It’s unforgivable that you should do such a thing!

5, someone quietly followed you, click to understand!

If you click on the link in these messages, you will get a malicious Trojan horse program, which may steal the payment password of online banking, QQ, WeChat, Alipay and other software on your mobile phone and steal the user’s property.

How to protect the security of mobile phone accounts

The first move: open the application lock.

Many mobile phone security centers or settings have the function of encrypting applications. After adding application locks to WeChat, Alipay and online banking apps, they must be unlocked every time they are opened.

The second measure: change the password regularly.

Important accounts such as WeChat and Alipay have their passwords set separately and changed regularly, which can effectively prevent their own accounts from being stolen.

The third measure: online chat does not reveal important information.

The network world is complex, so we should be careful when chatting online. Never reveal your important information during online chat, including bank card number, mobile phone password, home address and other information.

In case "people with a heart" use this information as a "key" to steal your property.

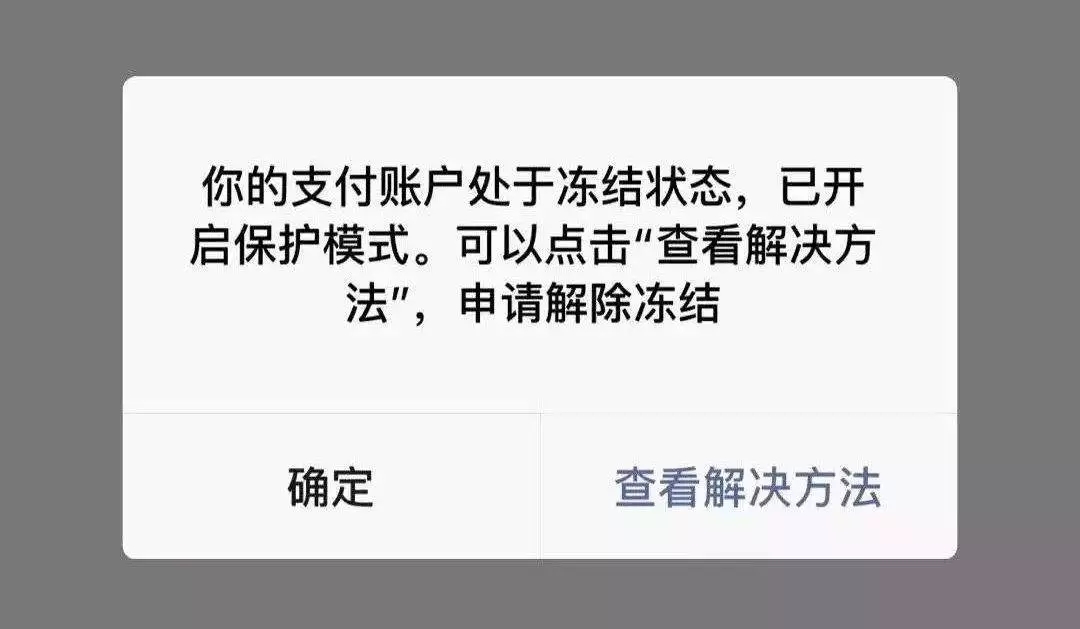

The fourth measure: freeze the account.

Wechat, Alipay and online banking App all have the function of freezing or reporting the loss of accounts. After the mobile phone is lost, you can log in to your account with a friend’s mobile phone to set it up. During the loss reporting period, the thief can’t steal the account funds.

The fifth measure: please download unofficial software carefully.

Don’t click on the unofficial download link at will. It is suggested to install the official version of anti-virus software on your mobile phone, which can not only intercept all kinds of fraudulent short messages, identify the information sent by pseudo base stations, but also warn you when you find virus software, which can avoid property losses to a certain extent.

Note: intentionally entering the wrong password is of little effect.

After the mobile phone was stolen, I used my friend’s mobile phone to log in to my account and deliberately entered the wrong password many times until the account was frozen. After Alipay was frozen, it took 3 hours to try again. But by retrieving the password, it can be thawed immediately, so this method has little effect.